LNG Japan is committed to securing upstream resources so as to contribute to optimization of global energy supply and demand, and in particular, stable supply of resources to the Japan market.

LNG Japan’s access to underground resources began in the 1970s.

At that time, we confirmed the existence of underground resources to support a long-term LNG sales contract of 20 years and realized sales to the Japanese buyer, and launched LNG projects in Indonesia (Arun LNG and Bontang LNG).

From then until the present day we have been involved in large-scale projects, including QatarEnergy LNG S(1) in Qatar, Tangguh LNG in Indonesia and Scarborough Gas Project in Australia, and smaller projects elsewhere in Indonesia. In doing so, we have accumulated expertise in upstream business development.

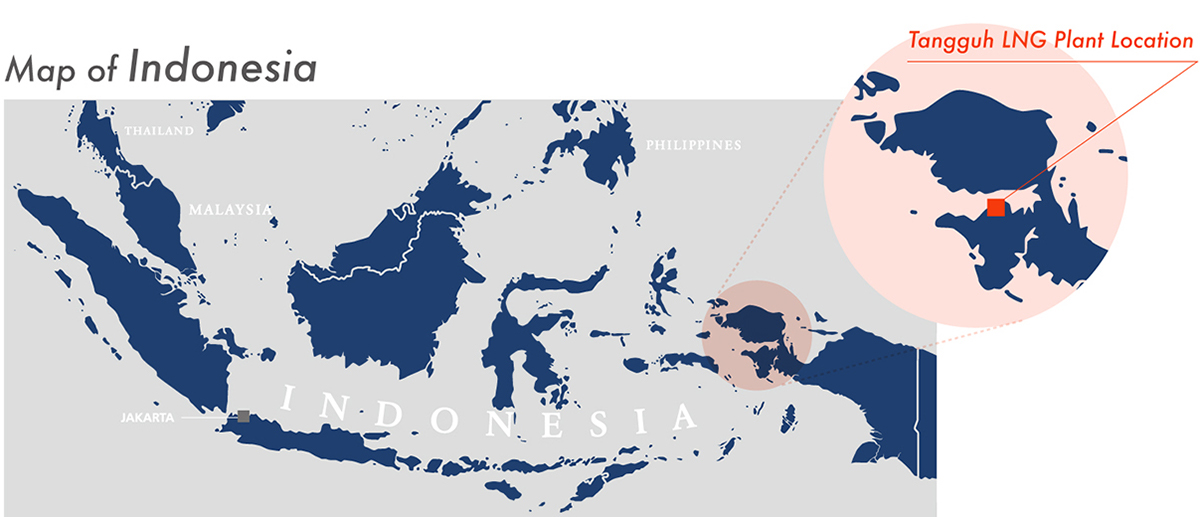

The Tangguh LNG Project is the third major LNG project in Indonesia, developed by unitizing the Muturi block, Berau block and Wiriagar block, located in the province of Papua Barat, Indonesia.

In 1999, LNG JAPAN joined this project by acquiring a 5% share in the Muturi block from BG International Ltd. and others. ln 2004, we increased our share to 34.23% in the Muturi block (7.35% in the Tangguh LNG Project) by acquiring an additional 29.23% interest from BG International Ltd.

In March 2005, we, along with other Tangguh partners, made the final investment decision (FID) to proceed with development of two LNG process trains (Trains 1 & 2) and an offshore gas field, and started production in June 2009. The LNG process trains have a production capacity of 7.6 million tons per annum (mtpa) and have been delivering LNG to Japan, Indonesia, China, Korea, and the West Coast of North America based on long-term sales and purchase agreements.

In addition, in September 2023, the third LNG process train (Train 3) with a production capacity of 3.8mtpa has started its production.

This additional production will play an important role in supporting Indonesia’s growing energy demand, with up to 2.8mtpa supplied to the state electricity company PT. PLN (Persero). Meanwhile, the remaining up to 1mtpa will be supplied to THE KANSAI ELECTRIC POWER CO., INC., contributing to Japan’s national energy security.

As a major LNG supply terminal in Indonesia, there are high expectations that this project will make a greater contribution to the stable supply of LNG in the Asia-Pacific region.

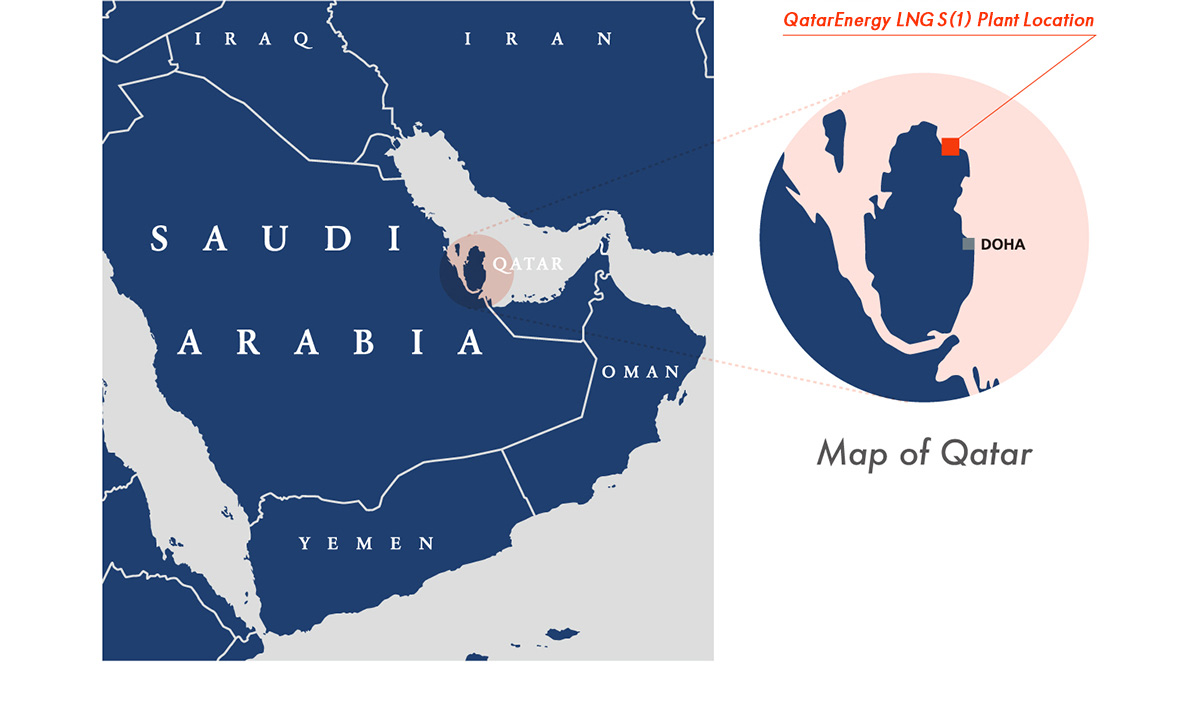

In September 1997, LNG JAPAN joined the project by acquiring 3% equity interest in QatarEnergy LNG S(1), a Qatar LNG project led by QatarEnergy (a Qatari state-owned company) and ExxonMobil. Upon our participation, we arranged a US$300 million loan to QatarEnergy.

QatarEnergy LNG S(1) supplies 4.8 million tons of LNG per year to Korea Gas Corporation from its LNG production trains 1 and 2, which are capable of producing a total of 6.6 million tons per year. The company has continued smooth operation since its first shipment in August 1999.It also supplies LNG on a spot contract basis to LNG markets all over the world.

In addition, QatarEnergy LNG S(1) produces by-products such as condensate and sulphur. In 2005, it set up a liquefied helium plant as Helium-1 project in cooperation with other Qatar LNG production projects, which has since produced 660 million standard cubic feet of helium a year.

Subsequent to Helium-1 project, Helium-2 project started commercial operation in 2013, producing 1.3 billion standard cubic feet of helium per year. Utilizing our business expertise cultivated through long-standing efforts in Qatar, LNG JAPAN’s involvement in this project entails working as buyer’s representative for a Japanese offtaker in Japan’s first direct purchase contract from a helium producer. We have also established a helium handling joint venture with a local Qatari company and the Japanese offtaker, which is equipped with the very first helium transfilling facility in Qatar.

In August 2023, LNG JAPAN entered into a Sale and Purchase Agreement with a wholly owned subsidiary of Woodside Energy Group Ltd (“Woodside”) to acquire a 10% non-operating participating interest in the Scarborough Joint Venture, through LNG JAPAN’s subsidiary, LJ Scarborough Pty Ltd (“LJS”). In addition, LJS received confirmation of “adoption as an eligible project for providing equity capital financing and liability guarantee” from the Japan Organization for Metals and Energy Security. In March 2024, all the conditions precedent to the Sale and Purchase Agreement were satisfied, and the acquisition was completed.

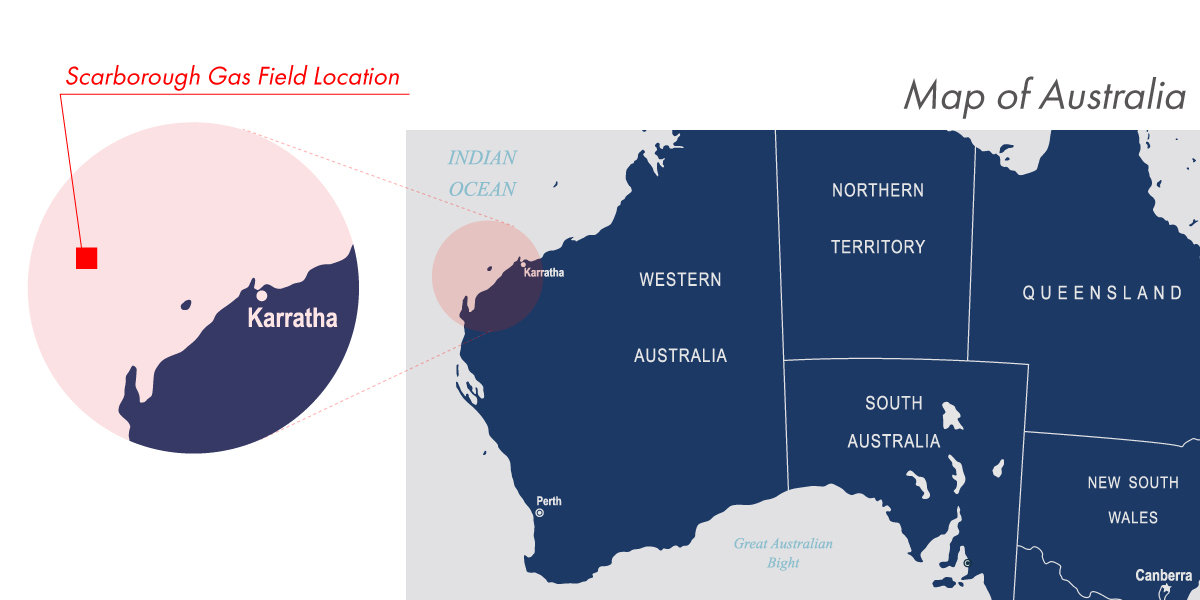

The project, for which the final investment decision was made in November 2021, will transport via a subsea pipeline to an onshore liquefaction facility for the production of LNG, natural gas taken from the subsea Scarborough gas field which is located approximately 375km off the coast of Western Australia. Our investment covers the development of the gas field and the transportation via pipeline to the liquefaction facility. We will convert the produced gas into LNG based on a Processing and Services Agreement with the liquefaction company and sell the LNG. The Scarborough gas field will supply gas to support production of up to 8 million tonnes per annum (“Mtpa”) of LNG, and domestic gas equivalent to 15% of LNG production which will be reserved for domestic use in support of the State of Western Australia’s domestic gas policy. LJS will independently market and sell its equity LNG cargoes (up to 0.8 Mtpa).

The Scarborough reservoir contains a relatively low volume of CO2 (less than 0.1%) and its greenhouse gas emissions during the production phase will be mitigated as a result of the implementation of energy-efficient measures.

As a 10% participating interest holder in the Scarborough Joint Venture, LJS will cooperate with Woodside in developing the project, which is targeting first LNG cargo in 2026. LNG JAPAN will contribute to the further development of Australia, and will further work towards the realization of a lower-carbon society and provide a stable and secure supply of lower-carbon energy, particularly in Japan and other Asian countries.

Video provided courtesy of Woodside Energy.